Carbon taxation aims to reduce the amount of carbon dioxide emissions by imposing a tax on the use of fossil fuels. The price of fossil fuels, such as oil and gas, is increased to reflect the environmental damage caused by releasing carbon dioxide (CO2) into the atmosphere. Policy makers expect carbon taxes to be an effective way to reduce greenhouse gas emissions as they provide an economic incentive for individuals and companies to switch to cleaner, more sustainable energy sources. In addition to reducing carbon emissions, the tax also generates revenue for the government, which can be reinvested in green initiatives and social compensation schemes. As first outlined in the national energy and climate plan (NECP) for 2021 to 2030 by the Luxembourgian government in 2019, the carbon tax rate was set to 20 Euros in 2021 and then increased stepwise to 25 Euros in 2022 and finally 30 Euros per emitted ton of CO2 in 2023. Afterwards, the government plans to increase the tax by 5 Euros a year from 2024 onwards.

Emissions and current taxation: an overview

With its carbon tax, Luxembourg aims to make much needed progress on the path to decarbonization. As an EU member state, Luxembourg has pledged to cut its greenhouse gas emissions by at least 55% until 2023, compared to the level of emissions in 1990 to adhere to the “European Green Deal”. In order to properly analyze Luxembourg’s carbon-related taxes and subsidies, the Institute for Advances Studies (IHS) Vienna conducted a study commissioned by the Chambre des salariés of Luxembourg[1]. Some results are presented here and represent the data available as of 2022.

To analyze current taxation and hypothetical taxation scenarios, data on CO2 and greenhouse gas (GHG[2]) emissions, physical energy flows, energy and transport taxes are analyzed, provided mainly by Eurostat, along with other additional sources for further refinements. There are various international reporting standards for air emissions, and our main data source is based on the Air Emissions Accounts principle, which covers all emissions by residents, including those produced abroad. In contrast, the Air Emission Inventories record emissions within a specific territory. In 2019, CO2 emissions by Luxembourg’s residential industries and households totaled 9.75 million tons, with households producing 1.53 million tons. When considering all GHG emissions, these figures rise to 10.72 and 1.58 million tons, respectively. For the taxation scenarios in this study, these numbers are slightly adjusted to allow for the analysis of non-resident households, such as cross-border workers, foreign tourists and “fuel tourists”, and non-resident corporations, such as transportation companies. Furthermore, aviation emissions are adjusted to remove potential distortions.

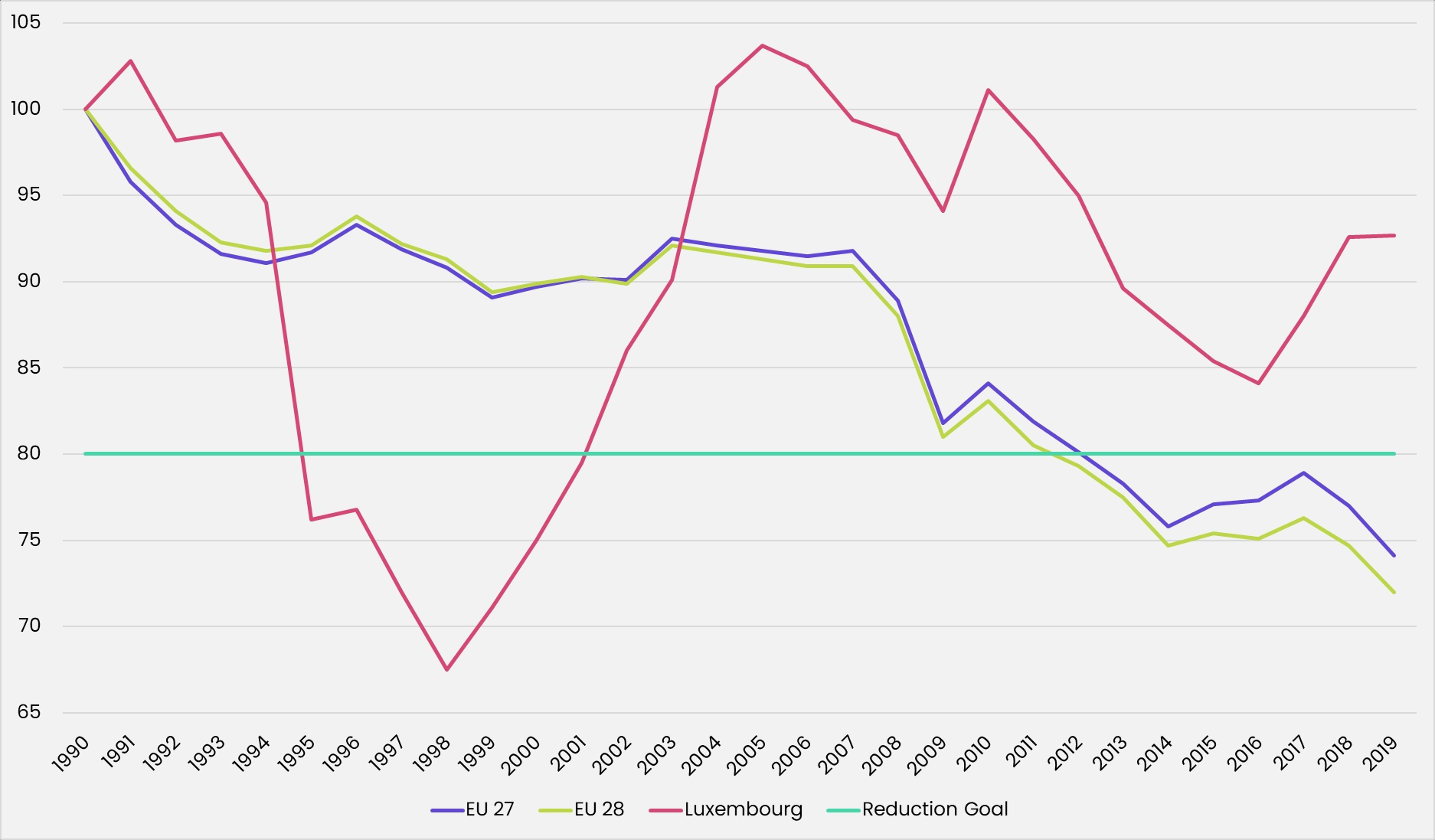

According to Eurostat, Luxembourg had the highest per capita emissions of GHGs in the EU, amounting to 20.3 tons in 2019. The average of the EU-27 countries was 8.4 tons in the same year. The figure below shows the development of GHG emissions in Luxembourg and the EU since 1990, according to the Eurostat Air Emissions Database. In the EU’s “2020 Climate & Energy Package”, countries agreed to reduce GHG emissions by 20% compared to 1990. Luxembourg’s emissions where still at 92.7% of the GHG emissions level of the base year 1990 in 2019, whereas the EU as a total already reached the 20% reduction goal at the same time. As can be seen in the figure, Luxembourg was on a solid reduction path between 1993 and 1998 until emissions began to increase again sharply until 2005.

Chart title: Development of net GHG emissions (‘Kyoto basket’) in Luxembourg and the EU (1990=100) between 1990 and 2019.

Source: IHS 2022

To analyze current taxation schemes, datasets from the Eurostat Environmental Taxes Database are employed, which contain industry-level statistics about revenue collected through taxation of energy, transport, pollution, and resources in every EU country. Energy and transport taxes are included in the analysis due to their close connection to GHG emissions. In Luxembourg, more than 55% of relevant taxes were paid by non-residents in 2019. Confidentiality issues arise in small countries like Luxembourg, where many sectors do not show a value for taxation due to confidentiality reasons. Consequently, certain assumptions and aggregations are made to address these issues.

Energy taxes include taxation of energy production for both transport and stationary purposes, as well as revenues from carbon taxation and GHG emissions-allowances through the EU-ETS, which is the European Union Emissions Trading System. Transport taxes mainly target the ownership of motor vehicles and other transport equipment. Pollution and resource taxes are not included in the analysis, as they do not show a direct connection to GHG emissions.

Subsidies: The opposite side

In Luxembourg, as in many other countries, various subsidies benefit the consumption and incineration of carbon-based energy products, such as diesel and gasoline. These carbon subsidies overtly counteract climate protection efforts. In the context of this analysis, it does not matter if the measure considered is legally defined as a subsidy. Most of the subsidies are, in fact, privileges and tax exemptions. For this analysis to be defined as a “carbon subsidy” the decisive property is a direct link to the increased use of carbon-based energy products. The estimated total amount of these subsidies varies significantly, ranging from 14 million to 140 million Euros in 2018, and even up to one billion Euros according to one study.

Our study examines selected carbon subsidies in Luxembourg but does not claim to cover all existing subsidies at the time of publication in 2022. The identified subsidies are the following six:

- Diesel privilege: The difference in taxation between diesel and gasoline (0.112 Euros per liter), with diesel receiving a lower tax rate. It benefits virtually all sectors and economic entities in Luxembourg, including foreign households and businesses. The OECD recommends adjusting the excise taxation of diesel to the taxation of gasoline because diesel has a higher carbon content than gasoline.

- Electricity privilege for businesses: Business consumers pay 0.5 Euros less excise duties per megawatt-hour than household consumers, providing a subsidy for the corporate sectors. Luxembourg relies heavily on electricity imports, and electricity production in Europe is still largely dependent on combustible fuels.

- Tax exemptions for diesel used in agriculture and trains: Diesel is exempt from excise duties in these industries, providing a subsidy for the agricultural and transport sectors.

- Lower excise duties for gas oil used for heating purposes: Gas oil produces almost the same amount of greenhouse gas emissions as diesel but is subject to substantially lower excise duties in Luxembourg (0.453 Euros below gasoline).

- Exemptions from excise duties for non-business use of coal: Coal, coke, and similar products, which are the most GHG-intensive energy products, are exempt from excise duties for non-business users in Luxembourg.

- Free Allocation of Emissions Trading System (ETS) Allowances: Companies in countries participating in the EU-ETS usually have to buy emissions certificates to be allowed to emit greenhouse gases. A large share of these emission certificates is freely allocated (especially in the manufacturing sector) to the polluters. This measure is considered a subsidy and a direct transfer of money positively correlated with the amount of pollution.

Some subsidies, like the favorable tax treatment of company cars for personal use and the deductibility of commuting expenses, cannot be considered due to limited data availability. Energy tax rates in Luxembourg are among the lowest in the EU, resulting in around 70% of fuels used for road transport being sold to motor vehicles not registered in Luxembourg. However, defining this lower taxation as a subsidy is difficult due to the lack of a clear benchmark for unsubsidized prices and was omitted in this study.

The selected list of six carbon subsidies above is estimated to amount to 417 million Euros in 2019. Foreign households and corporations not located in Luxembourg profit the most of these, while households located in Luxembourg profit the least. Luxembourg’s manufacturing sector received the largest share of direct carbon-related subsidies among the industry sectors, amounting to 68.5 million Euros. Resident corporations together received 182.8 million Euros, while resident households got 68.2 million Euros of direct subsidies. Non-resident entities acquired 165.9 million Euros, mainly due to low taxes for diesel. When analyzing subsidies per unit of GHG emissions, the public administration and defense sector received the highest subsidies per emitted unit, while the transport sector received the lowest. Households were found to receive more subsidies per unit of emissions than any other entity.

Ultimately, these subsidies distort competition, lock in inefficient technology, lead to an inefficient allocation of resources and strain public finances. They undermine the carbon-price signal and discourage efficient use of energy resources in Luxembourg. Despite recommendations made by the OECD to identify and remove some of these subsidies, little progress has been made. Addressing these issues will require further investigation into existing subsidies and policy changes that promote the efficient use of energy resources and reduce greenhouse gas emissions.

Carbon taxation scenarios

Various taxation scenarios related to carbon emissions are analyzed. The aim is to understand the implications of different carbon tax approaches, which could help in shaping future policies. By considering four fictive taxation scenarios, in addition to current carbon-related energy and transport taxes, the effects of these scenarios are evaluated. To avoid theoretical double taxation, sectors targeted by the EU-ETS are excluded from the fictive taxation in all scenarios.

The base scenario represents the situation as of 2019. It includes all existing energy and transport taxation during that time, without taking into account Luxembourg’s carbon tax. This base scenario serves as a reference point for the other scenarios. Moving on to the first scenario, an additional tax of 30 Euros per ton of CO2 is considered on top of the existing energy and transport taxation for all emissions, except those in the ETS sectors. This level of taxation, targeting only CO2 emissions, is equivalent to Luxembourg’s carbon tax in 2023. The second scenario, also called the redistribution scenario, explores the idea of abolishing the current energy and transport taxation and replacing it with a revenue-neutral carbon tax targeting all non-ETS emissions in Luxembourg. In the third scenario, the assumption is made that Luxembourg introduces a carbon tax equivalent to the average level of taxation in all neighboring countries and the Netherlands. For this article, we will only focus on the most ambitious of our scenarios: scenario four.

The fourth scenario explores pricing the damage scenario of emissions and entails introducing a carbon tax of 203.14 Euros per ton of CO2 or GHG emission on top of existing energy and transport taxation, while excluding ETS emissions. There is an alternative version of this scenario that additionally targets (and thus double-taxes) ETS emissions. This tax amount is based on the social cost of carbon (SCC) principle, which will be explained in more detail below.

The social cost of carbon

One of the main challenges in implementing effective carbon taxation policies is accurately evaluating the cost of carbon emissions, which have significant social costs that are at least not yet reflected in the market price of fossil fuels. One of the taxation scenarios included in the study is therefore based on considerations on how to evaluate the “true” cost of carbon.

The main idea behind the social cost of carbon (SCC) concept is to put a price on carbon emissions and aims to find a value corresponding to the monetary amount of net damage caused by one ton of CO2-equivalent emissions for all present and future generations worldwide. One of the most recent and comprehensive SCC-studies was conducted by Rennert and colleagues in 2022. This study estimates the cost at 185 Euros per emitted ton of CO2. Other studies provide a range of different assessments. In their Methodological Convention 3.0, the German Environmental Agency estimated the cost to be 203.14 Euros per ton of GHG emission in 2021. Finding this price includes accounting for the idea that people tend to value events the future less than present events. Therefore, it assumes a social discount rate of 1%, weighting the welfare of the next generation with 74% of today’s welfare. The value given by the German Environmental Agency was also used as a reference in our own calculations of taxation scenario four. Among the lowest estimates is one of 51 US dollars in 2020 by the Interagency Working group, assuming a discount rate of 3%, while the highest estimates, for instance in a study by Ekholm in 2018, go up to several thousand US dollars per emitted ton of GHG by 2030.

The SCC approach has been criticized by some researchers. In a 2020 study, Kaufmann and colleagues, for instance, argued that this approach tends to be of little help to policymakers due to the multitude of uncertainties that come with it. The calculations require a lot of climatic as well as socioeconomic assumptions, resulting in a wide price range. One of the main drivers of the price range are the various discount rates used in calculations. In general, it can be said that the true cost of carbon emissions is unknown. Still, there is strong evidence suggesting the price should be a great deal higher than current carbon taxes.

Compared to the carbon tax of other European countries, Luxembourg’s carbon tax can be placed somewhere in the middle range. In 2022, Sweden, Liechtenstein and Switzerland taxed a ton of CO2 at around 117 Euros, followed by Norway (79 Euros) and Finland (77 Euros). Also in the middle range but still above Luxembourg are France, Ireland and the Netherlands with between 40 and 45 Euros. Austria, Iceland and Luxembourg are taxed roughly the same, while countries like the UK (approximately 21 Euros), Latvia and Spain (both 15 Euros) charge less per emitted ton of CO2. The lowest carbon taxes within Europe are found in Poland and the Ukraine with less than one Euro per ton. Notably, quite a few countries in Europe do not have an explicit carbon tax (yet), including most of Eastern Europe, but also countries like Germany, Italy and Belgium.

The calculations of scenario four in our own study, which assumes a carbon tax of 203.14 Euros, show that resident households and corporations would have to pay 1.4 billion Euros in the short-term if the carbon tax was based on CO2 emissions only. Considering all GHG emissions would result in short-term effect of 1.6 billion Euros. If we add exports as well as non-resident households and corporations, we arrive at 3 billion Euros if based on CO2, or 3.2 billion Euros if based on GHG emissions. As a comparison, scenario 1 arrives at 626 million Euros for resident households and companies and almost 1.4 billion Euros when including non-resident entities and exports.

In summary, by evaluating these various taxation scenarios and their potential impacts, a better understanding can be gained on the most effective carbon tax approaches. This information could then be used to guide future policy decisions in addressing carbon emissions and climate change.

A Way forward

Carbon taxation and subsidies are important policy tools that can help to reduce greenhouse gas emissions and promote sustainable practices. In Luxembourg, these policies have only been successful in reducing emissions to a certain degree and promoting renewable energy to some extent. However, they have yet to unfold the effectiveness needed to achieve the government’s 55% emissions reduction target by 2030. To meet these targets, new policies and incentives will need to be introduced.

Current research strongly suggests that it is essential for countries to implement ambitious carbon taxation policies. Considering the results above, one of the most effective measures could be to introduce a substantially higher carbon tax than currently in force, while also abolishing carbon-subsidies. The revenues of the former could then be used to support low-income households and key industries in their decarbonization efforts. Another potential policy that could be introduced is a tax on carbon imports, which could be achieved together with other nations under the roof of a so-called “carbon club”. This would help to encourage trading partners to reduce their carbon emissions as well, by adding a penalty to goods produced in countries with high emissions. Such a tax would help to level the playing field for producers in countries like Luxembourg, which has implemented carbon taxes, and could help to reduce emissions across borders. As a small and highly interconnected economy, such enterprises should hardly be a solo effort but rather be considered at a European level. By continuing to invest in sustainable technology and introduce new policies and incentives, Luxembourg can move towards a greener, more sustainable future.